Corporate Pension Schemes are established by a company or an employer for the benefit of their employees so they can receive an additional income at time of retirement.

Any company may adhere to a corporate pension fund.

Who are we ?

Pension Scheme Administrator for large self-administered pension fund and two multi-employer pension funds: MUA Multi Employer Pension Fund and United Mutual Superannuation Fund (UMSF).

- We have been providing a full range of pension administrative services to a portfolio of Defined Benefit and Defined Contribution schemes in Mauritius since 1985.

- Licensed and regulated by the Financial Services Commission with the following licenses

o Pension Scheme Administration

o Investment Advisory [unrestricted]

o Actuarial Services - 35 years of corporate pension experience

- The team:

o Our dedicated pension administration team delivers a full range of pension administration services to Defined Benefit, Defined Contribution, or hybrid schemes either as part of a self-administered fund or as part of a multi-employer fund.

o Our team of pension administrators come from management, accounting or actuarial backgrounds. The management teams each have more than 10 years’ experience in the pensions industry. - Our clients:

Our clients come from various industries: construction, education, finance, healthcare, hospitality & leisure, commerce and the sugar Industry. Our corporate pension solutions are made to measure and customised to fit the needs of employers.

Our services

Our team is specialized in pension scheme transitions and pension scheme conversions:

- Change of pension administrator

- Change of participation in one multi-employer pension funds to another

- Registration procedures with FSC, regulation authorities

- Daily management of the pension fund, including member management

- Organisation & secretarial services for management committees and/or Board of Trustees meetings

- Preparation & Distribution of Benefit Statements, Information booklets & employee meetings

- Implementation of pension scheme with FSC; drafting of legal documents

- Pension fund accounting

- Investment Strategy & Asset Allocation

- Active fund management; supervise and direct the investment of the assets of the Fund

- Liaison with brokers, custodians, banks and fund managers

- Monitor performance & asset allocation of all portfolios

- Calculation of Net Asset Valuation (NAV) for pension schemes

- Actuarial Valuation

- IAS 19 Disclosure Calculations

- Calculation & Projections

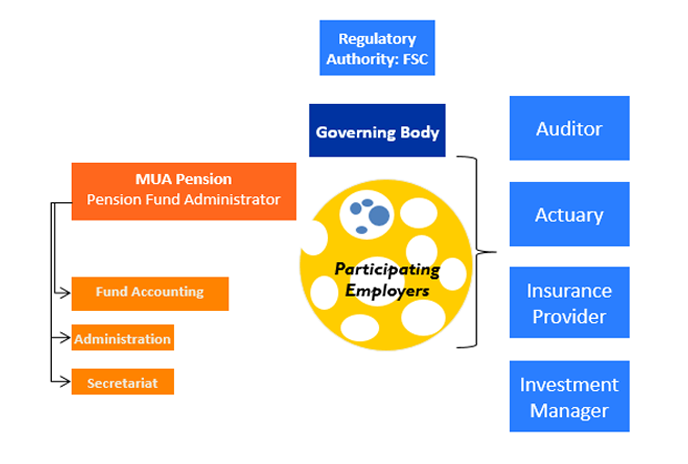

Example of a Pension Fund Structure

Individual Employee Account (IEA) are built from Employer & employee contributions, additional voluntary contributions and Transfer value

- At retirement, the Individual Employee Account (IEA) is used to pay a monthly pension for life

- A lump sum, representing a maximum of 25% of the IEA, can also be paid. The monthly pension will then be reduced proportionally.

For more information