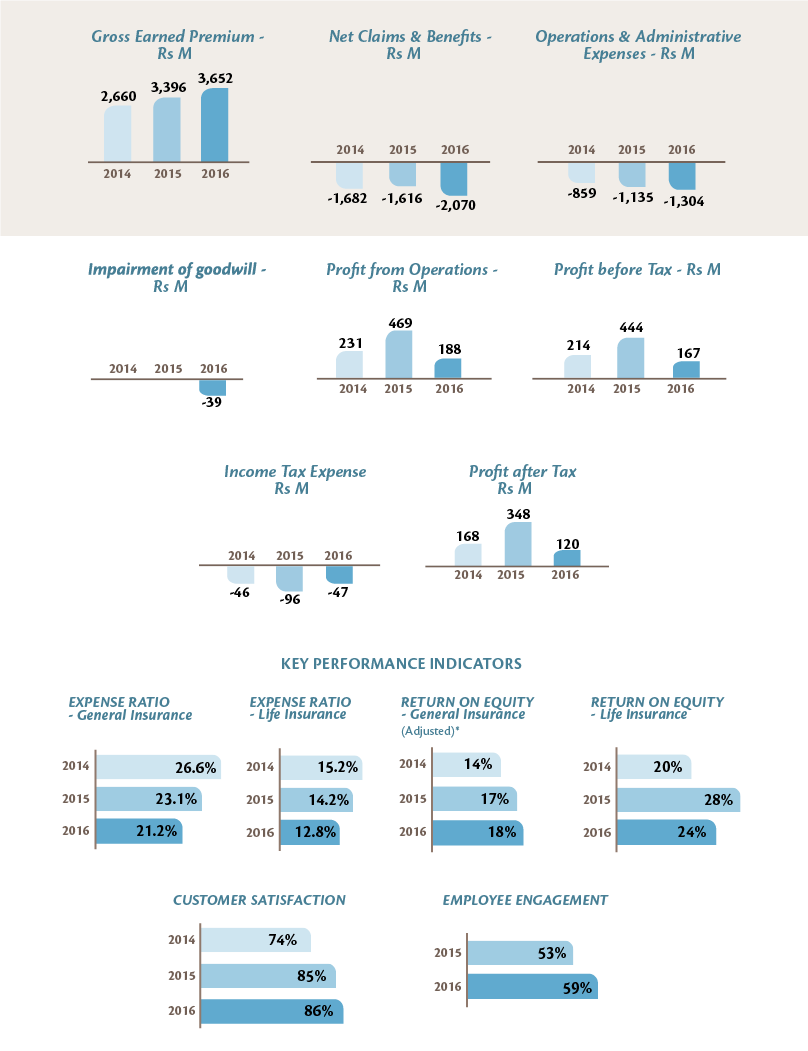

FINANCIAL HIGHLIGHTS

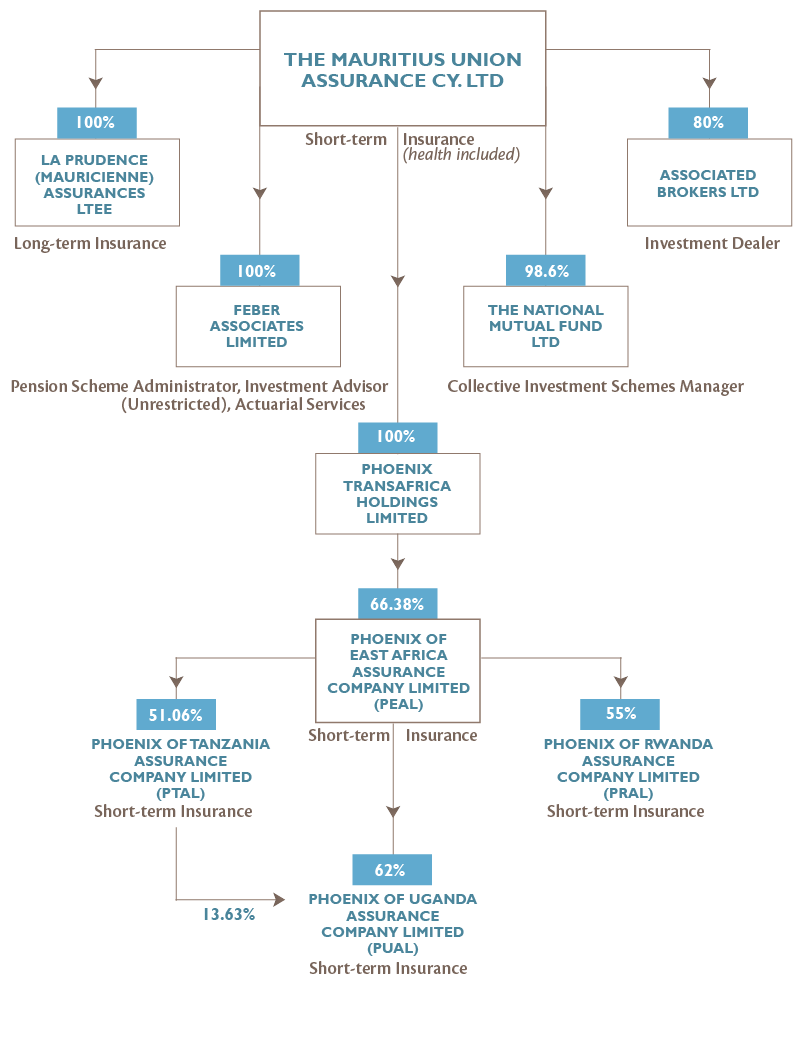

OUR GROUP

CORPORATE INFORMATION

REGISTERED OFFICE

4, Léoville L’Homme Street

Port Louis

Republic of Mauritius

Telephone: +230 207 5500

info@mauritiusunion.com

mauritiusunion.com

AUDITORS

Ernst & Young

ACTUARIES

Deloitte Actuarial & Insurance Solutions, South Africa

SECRETARY

ECS Secretaries Ltd

SHARE REGISTRY

Abax Corporate Services Ltd

MAIN BANKERS

ABC Banking Corporation Ltd

Afrasia Bank Limited

Bank One Limited

Banque des Mascareignes Ltee

Barclays Bank Plc

Hong Kong & Shanghai Banking Corporation Limited

The Mauritius Commercial Bank Ltd

SBI (Mauritius) Ltd

Standard Bank (Mauritius) Limited

State Bank of Mauritius Ltd

MANAGEMENT REVIEW

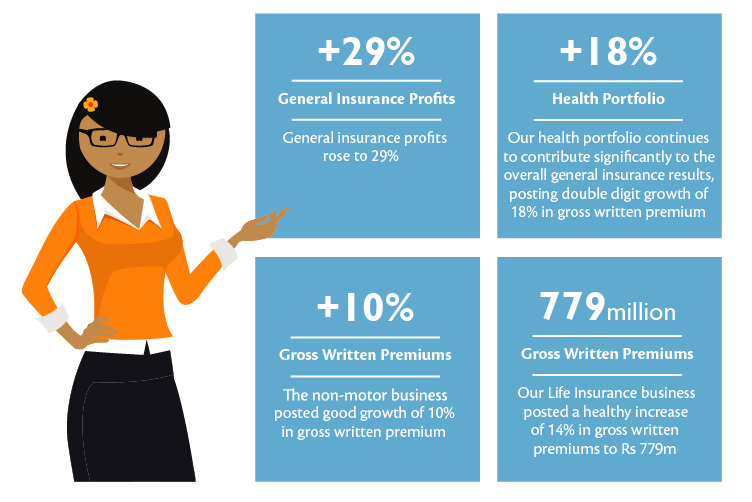

FINANCIAL HIGHLIGHTS – GENERAL INSURANCE

THE BOARD

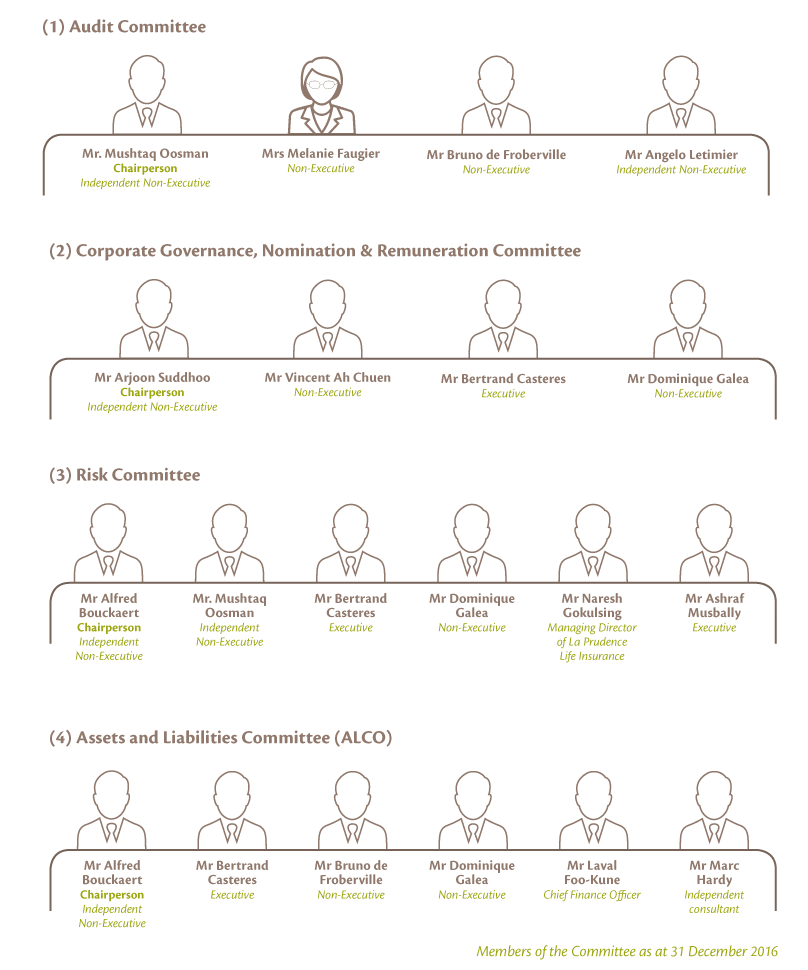

COMMITTEES OF THE BOARD

SENIOR MANAGEMENT

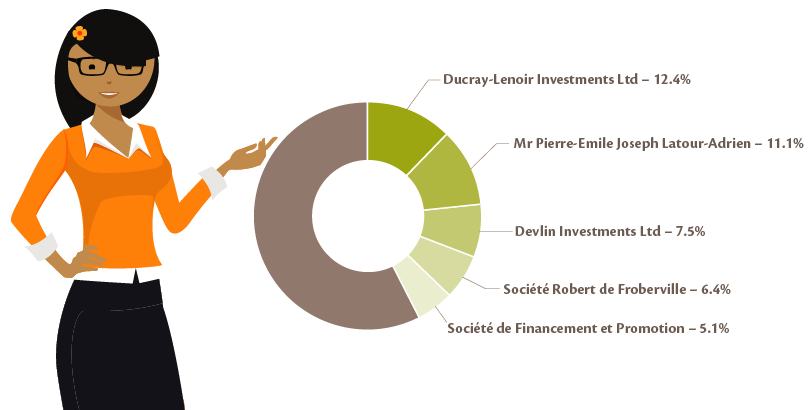

SHAREHOLDING

INTERNAL AUDIT

Our in-house internal audit team carries out the internal audit. The scope of their work encompasses:

Identification of risk areas and the evaluation of the level of risk for each risk area

Review of internal control processes and recommendations thereon to the Audit & Risk Committee and to the Management

Monitoring of the implementation of the recommendations and reporting on these to the audit committee. The team carried out 10 internal audit reviews during 2016.

INTERNAL CONTROL SYSYTEM

SUSTAINABILITY REPORTING AND ETHICS

The Company recognises that it operates within a broader social and economic community. Consequently, when it takes decisions and carries out its activities, it is committed to considering not only economic viability but also environmental consequences and social implications.

During 2016 the Group focused on addressing the most important health and safety priorities:

(a) Implementation of a building safety inspection plan where all safety aspects of the building are systematically check, on a monthly basis, to ensure that employees have the optimal environment to perform their work efficiently.

(b) Emergency preparedness to promptly respond to a variety of safety crisis scenarios (e.g fire, accident, major power failure or national catastrophe)

(c) The wellbeing of our employees is also of great importance. Two outdoor trekking activities have been organised for employees, combining team building, fun and physical activity. Moreover, the MUA sponsored the Ferney Trail in 2016, with over 40 employees participating.

CSR activities for the year 2016 included the following:

- Education and poverty alleviation

- Health & Wellness

- Training and empowerment/Development

- Assisting NGOs with the write-up of their projects

- Employee Involvement

OVERVIEW OF 2016

The challenging and competitive environment which had marked the previous year persisted in the local insurance market, as the Group embarked on the second phase of its African strategy.

On the international front, the continued sluggish global recovery and the added financial volatility weighed on investors. GDP growth recovered from the previous year to reach 3.1% in 2016.

Nonetheless, world growth is projected to reach 3.4% in 2017, supported by increased economic activity in advanced economies and emerging markets. Advanced economies are projected to grow by 1.9%, surpassed by growth of 4.5% in emerging markets.

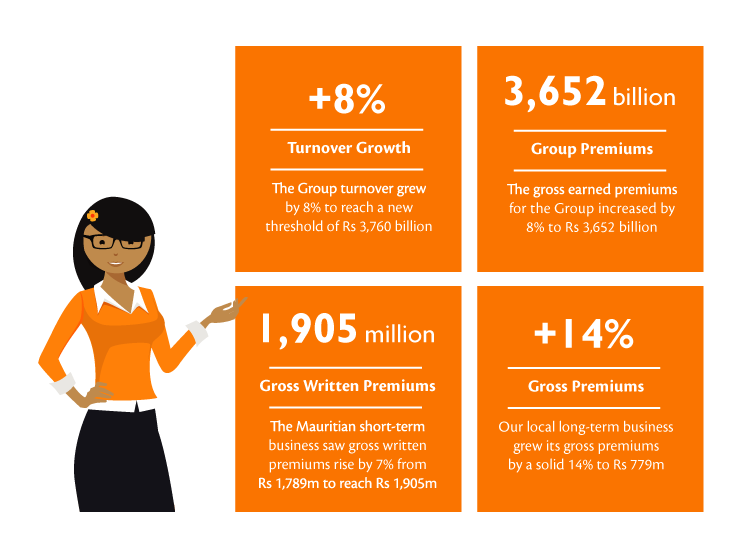

RESULTS

Despite the challenging market conditions, the Group maintained its solid performance with a stronger balance sheet, driven by good growth from Mauritius Union General Insurance and La Prudence Life Insurance in Mauritius. The Group turnover grew by 8% to reach a new threshold of Rs 3,760 billion

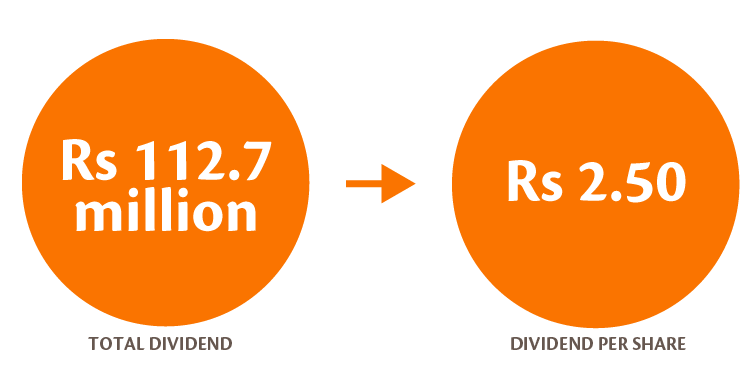

DIVIDEND

The Board has declared a total dividend of Rs 112.7m, equivalent to a dividend of Rs 2.50 per share.

ACKNOWLEDGEMENTS

We welcomed two new board members in 2016, reinforcing our already considerable collective experience in terms of accounting, audit and insurance

Mr Mushtaq Oosman is a Chartered Accountant with over 25 years’ professional experience in audit and financial advice. He retired from PwC at the end of 2015, and we are pleased to have the benefit of his extensive experience.

Our second appointee, Ashraf Musbally, has a 20 year career with La Prudence and Mauritius Union. He was appointed Group Managing Director of Phoenix of East Africa Assurance Company Limited (PEAL) in April 2016 and will report on our African business, as second executive director.

Mr Lakshamana (Kris) Lutchmenarraidoo resigned from the board in December 2016. This brings to a close ten years of service within the Group, where he has shown outstanding leadership and dedication. We thank him for all these excellent years of service.

I would also like to take this opportunity to thank all my fellow board members for their time, insight, commitment and support throughout this past year. Finally I would like to recognise the significant contribution of all our key partners, the brokers, accredited agents and salespersons who continue to accompany our clients on their insurance journey. Your collaboration strengthens our business and you have our gratitude.

After another positive and fulfilling year, it is fitting for me to pay tribute to the staff of the Mauritius Union Group for their dedication and remarkable effort. Our teams across six countries have been instrumental in achieving the significant goals outlined in this year’s Annual Report.

Finally I would like to recognise the significant contribution of all our key partners, the brokers, accredited agents and salespersons who continue to accompany our clients on their insurance journey. Your collaboration strengthens our business and you have our gratitude.

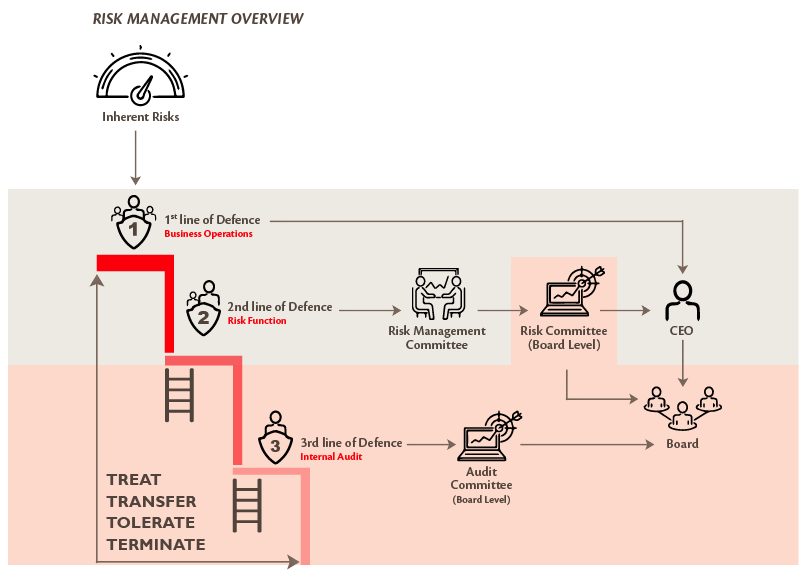

RISK MANAGEMENT OVERVIEW

The Group has a defined step by step approach with respect to risk management. The above diagram illustrates the high level process, whereby risks can be managed through the 4 T’s, at each step.

Treat: Take action to control the risk either by reducing the likelihood of the risk developing or limiting the impact it will have on the project

Transfer: Some of the financial risks maybe transferable via insurance or contractual arrangements or accepted by third parties

Tolerate: Nothing can be done at a reasonable cost to mitigate the risk or the likelihood and impact are at reasonable level.

Terminate: Do things differently and remove the risk.

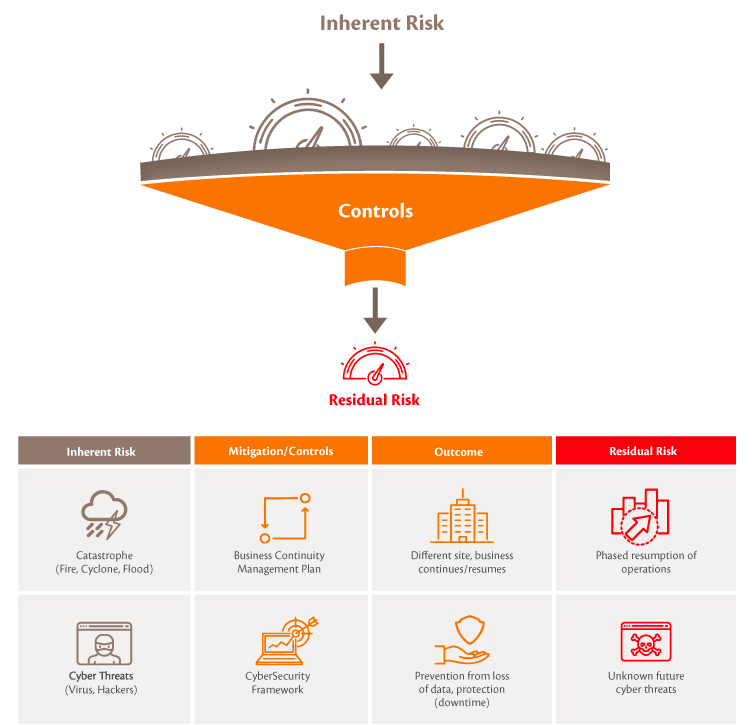

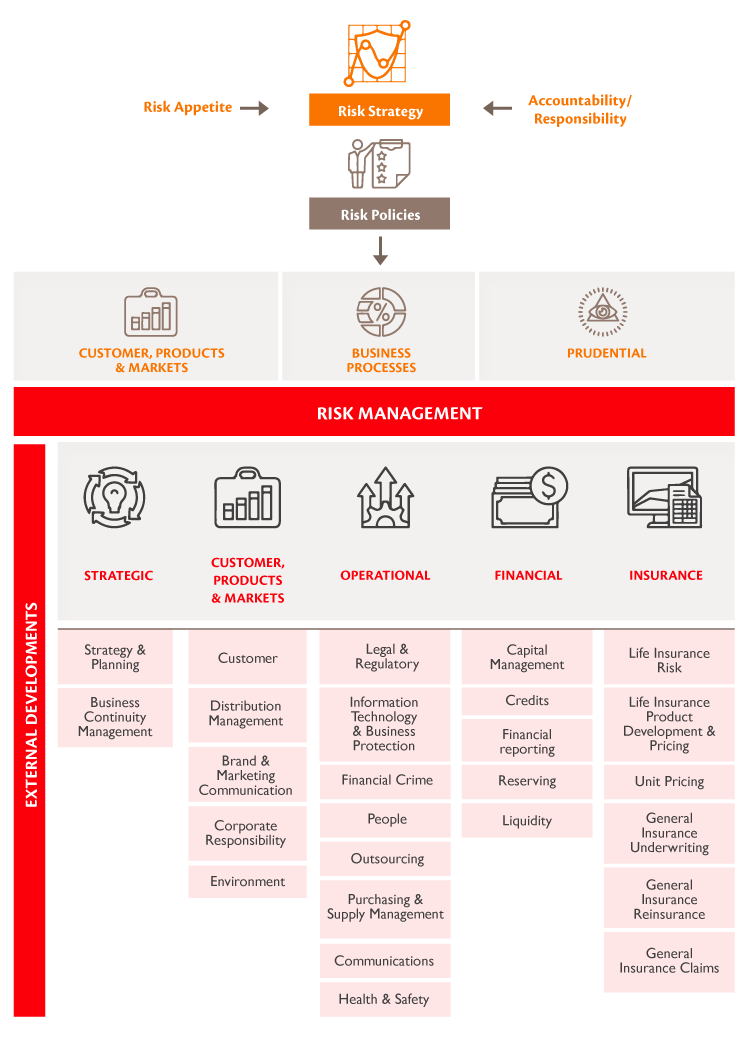

RISK CONTROL FRAMEWORK

The diagram below illustrates how the Group’s risk control framework minimizes the number of inherent risks to residual ones. The duty of the risk management is to review continuously the internal controls of the inherent risks and to monitor closely the residuals risks while taking actions when appropriate.

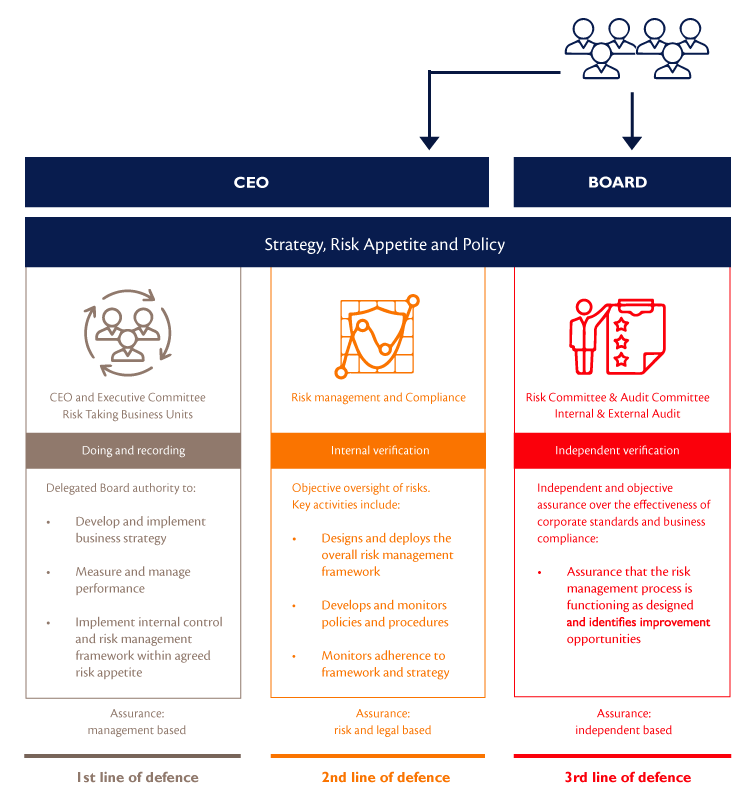

RISK MANAGEMENT RESPONSIBILITIES

The Mauritius Union Group has adopted the ‘three-lines-of-defence’ model where ownership for risk is taken at all levels in the Group. This model is widely adopted by financial services companies globally. It clearly sets out the risk management responsibilities across the business and is consistent with the current regulatory risk-based approach, encompassing corporate governance, systems and controls.

THE RISK MANAGEMENT FRAMEWORK

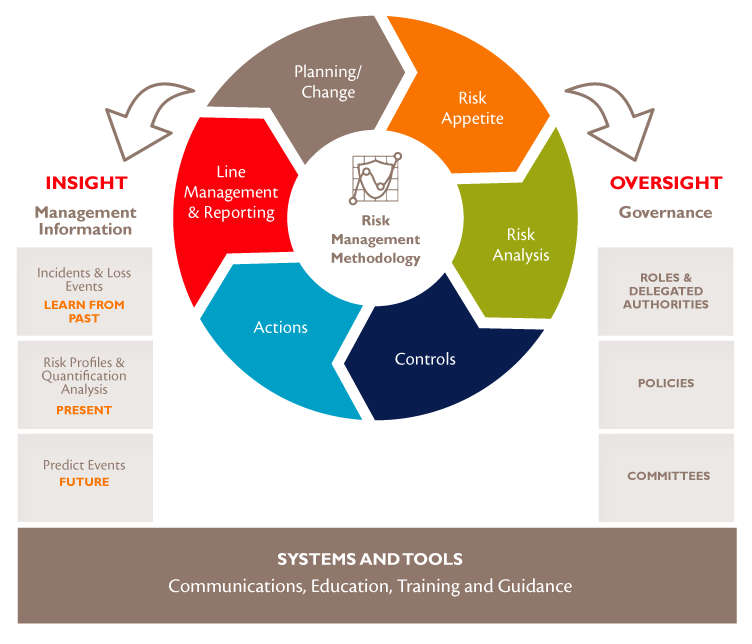

The Mauritius Union Group’s risk management framework forms an integral part of the management and Board processes as well as the decision-making framework across the organisation. The key elements of the risk management framework are illustrated below:

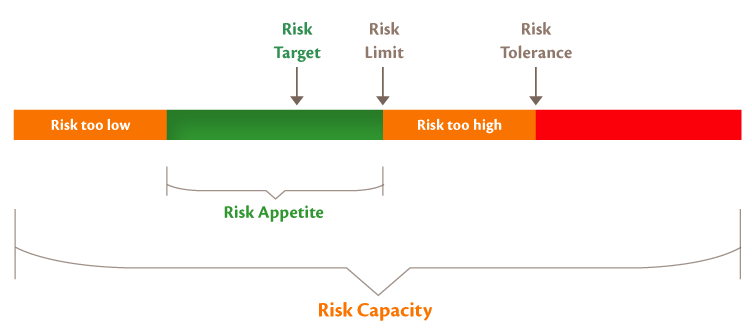

RISK APPETITE

The risk appetite is the level of risk the Group acknowledges and is able to accept in the pursuit of its strategic objectives.

RISK PROFILE

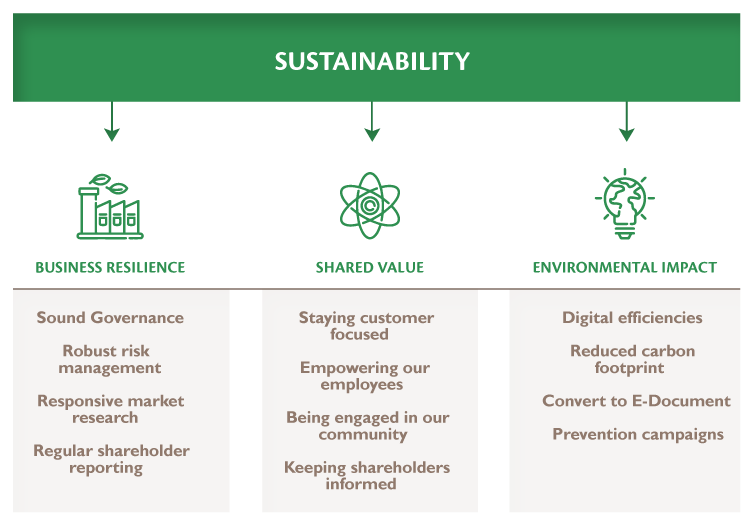

INVESTING IN TOMORROW

Sustainability has been one of the central tenets of the Mauritius Union Group’s Ambition 2017 strategy, launched at the beginning of 2015. The Group is well placed to understand the inherent and residual risks businesses and all its stakeholders face in the short, medium and long term. Ultimately the Sustainability of our business rests on three key pillars:

INVESTING IN OUR CUSTOMERS

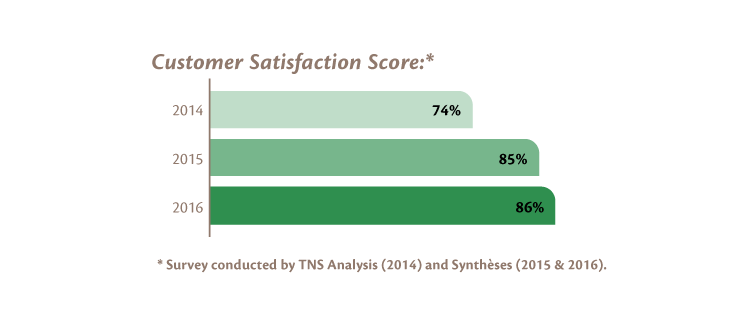

A central pillar of the principle of Shared Value is a concerted focus on our customers and the daily interactions our teams have with them. A number of initiatives in 2016 have reinforced this vision, ensuring that our clients are treated: in a fair and respectful manner; that they have clear access to information and suitable advice; that the products and services offered meet their requirements and that they have good levels of service once they have subscribed to one of policies. The aim is to accompany our clients at each stage of their insurance journey.

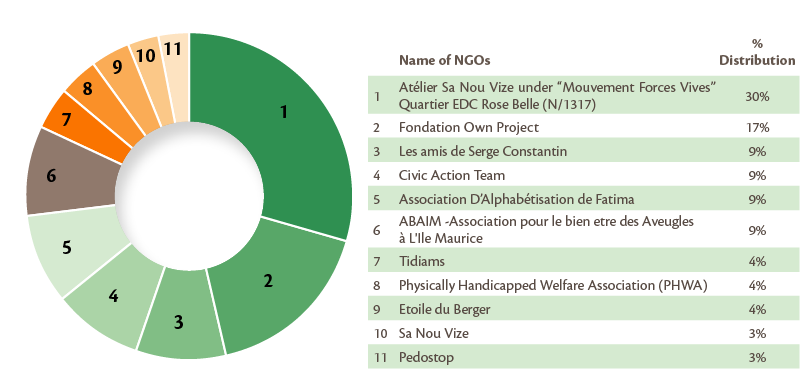

INVESTING IN OUR COMMUNITY

This year’s actions were mainly focused on education and the welfare & development of children, as we believe that education is a stepping stone towards poverty alleviation. Some of our main actions during the year were:

INVESTING IN OUR STAFF

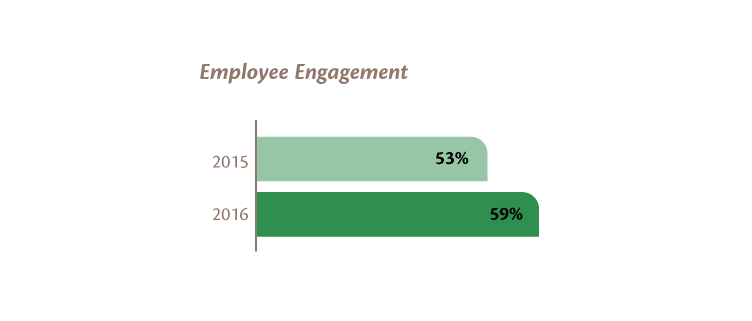

All the HR projects and initiatives aimed at training and empowering our staff, enabling them to deliver greater shared value. We aim to attract and retain the very best talent, whilst providing our teams with a sound organisational structure, career opportunities and the possibility of developing their skills and experience. We are seeing the fruits of our investment through the improvement in our employee engagement scores (survey conducted by AON Hewitt).

The Human Resources department spent over Rs 7.4m towards employees and their welfare in 2016. Around 69% of the amount spent was geared towards employee training and development programs which will in turn help towards achieving the company’s long term goals and sustainability.

INVESTING IN OUR ENVIRONMENT

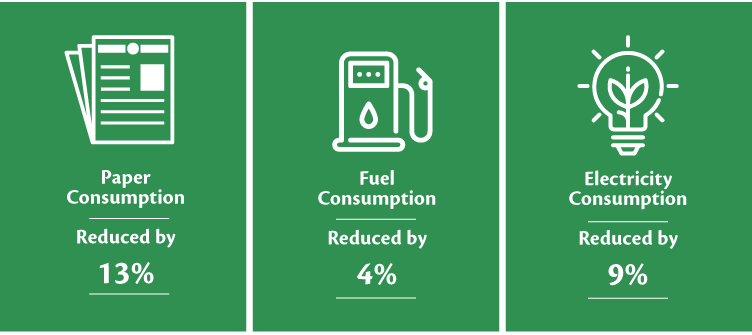

The measures taken over 2016 to curb all excessive and wasteful consumption of paper, fuel and energy have helped towards lowering our carbon footprint during the year.